-

Cale

March 8, 2021Stock futures slightly red again on another increase in bond yields this morning.

Cale

March 8, 2021Stock futures slightly red again on another increase in bond yields this morning.

WTI at $65.58, down 0.77% this morning after an overnight jump on the attempted drone attack on Ras Tanura. As per my initial comments last night, oil output appeared to be unaffected.

Quick summary in case you missed it: Houthis attempted to target Saudi oil infrastructure and military sites with 14 drones and 8 ballistic missiles yesterday. So, Iran continues to try and spark a little regional chaos...as short-sighted a strategy as that is, IMHO. More below.

Nat gas down 1.9% to $2.65 this morning. Two monthly reports of note for oil later this week - EIA STEO and OPEC MOMR, too.

Monday assorted links

1. BBG: U.S. Vows to Defend Saudi Arabia After Attack on Key Oil Site

The United States’ said its commitment to defend Saudi Arabia is “unwavering” after oil infrastructure in the kingdom came under missile and drone attack.

“The U.S. embassy condemns the recent Houthi attacks on the kingdom of Saudi Arabia,” the American mission in Riyadh said via Twitter. “The heinous attacks on civilians and vital infrastructure demonstrate their lack of respect for human life and their lack of interest in the pursuit of peace.”

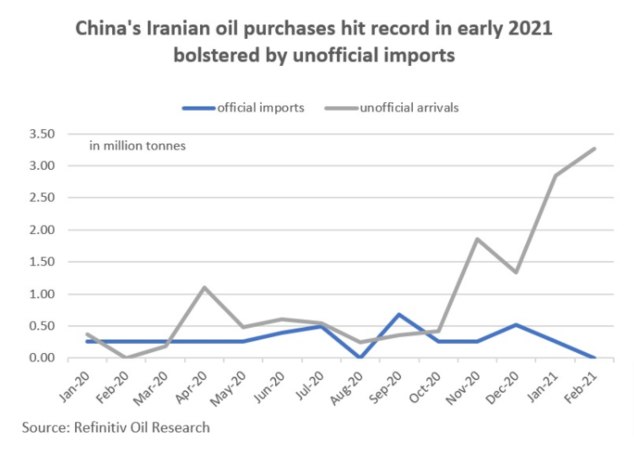

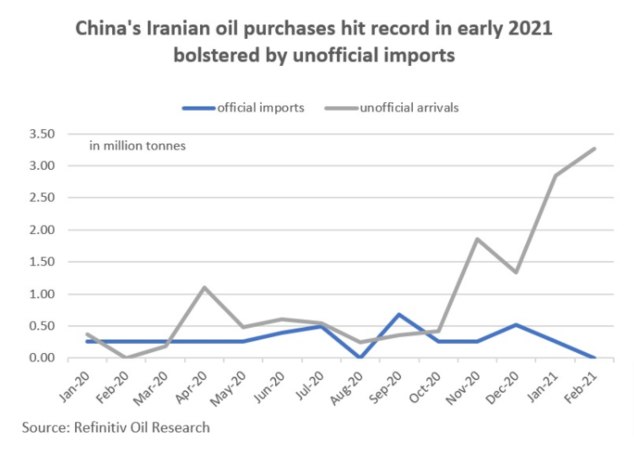

2. Reuters: Iran slips record volume of oil into China, reaches out to Asian clients for trade resumption

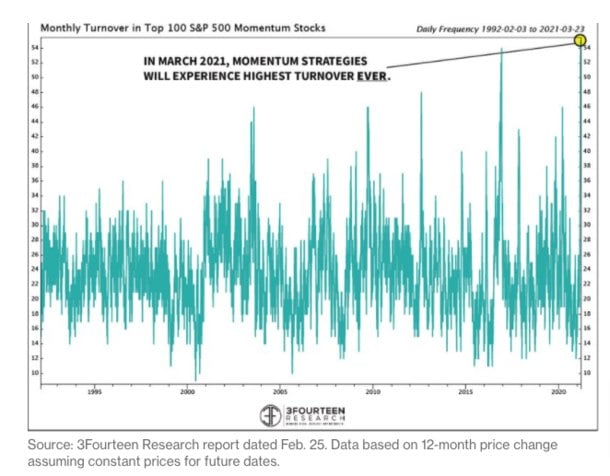

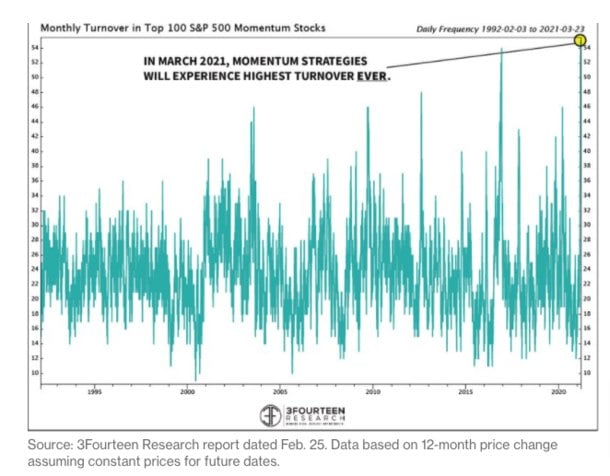

3. BBG: Momentum Quants Will Unleash the ‘Most Turbulent Rebalance Ever’

Almost a year after the S&P 500 hit the Covid-spurred low, momentum investors are set to pare exposures to lockdown favorites -- mega-caps and stay-at-home companies -- to join the boom in cyclical equities.

Think less Zoom Video Communications Inc., more Exxon Mobil Corp.

4. Research paper: The Equity Market Implications of the Retail Investment Boom

The inelastic nature of institutional demand allows Robinhood investors to have a substantial effect on stock returns during the COVID-19 pandemic. Despite their negligible market share of 0.2%, we find that Robinhood traders account for over 7% of the cross-sectional variation in stock returns during the second quarter of 2020. We furthermore show that without the surge in retail trading activity the aggregate market capitalization of the smallest quintile of US stocks would have been over 30% lower. Lastly, Robinhood traders are able to affect the price of some large individual companies that are being held primarily by passive institutional investors.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 5, 2021WTI up 2% to $65+. First time since last January. Nat gas down 0.22% to $2.74.

Cale

March 5, 2021WTI up 2% to $65+. First time since last January. Nat gas down 0.22% to $2.74.

Dollar up this morning, too - checked out of curiosity only cuz of that simultaneous green in WTI. Point being that whenever the dollar comes off...and seems likely over the next few years, IMHO...should be a little tailwind for oil prices, too.

Quick reminder: at year end 2020...so, 64 days ago...consensus for WTI on the Street was that it would be at an average price of $46.50...for all of 2021. Again, are currently at $65.

After OPEC+ yesterday, appears Goldman raised their Brent forecasts by another $5 to $75 in Q2 '21 and $80 in Q3 '21. Also forecasting OECD inventories to fall their lowest levels since 2014 - and $75 Brent through 2022, too. Morgan Stanley is leaving their (recent call) for an average Q3 '21 $70 Brent forecast unchanged...but notes it's possible we could see $80 then, too - their bull case.

Also noting energy sector high-yield spreads have hit the lowest level since 2018. Another good sign.

Broader market futures now flat after a red night. Market still chewing on Fed Chair's inflation comments yesterday.

S&P 500 on track for third week of declines, led by tech. No comment on our group over the same time period...because you know I will jinx it. Instead, coupla charts showing the growth-value rotation of late:

Related - time for a quick sidebar here on an important but kinda wonky aspect of Investing 101 that we are seeing play out of late...and which @Ryan Y highlighted a couple of times for us lately in recent posts like this one and this one.

And which I would summarize like this:

Unexpected spikes in interest rates can be bad for "growth investing."

Growth companies (let's call these companies, say, "tech and EVs and renewables") have high valuation multiples...which imply rapid earnings growth out into the future.

But the present value of those earnings depends on the discount rate - i.e. the interest rate you use to figure out what all those future earnings are worth - in today's terms. And while different investors use different discount rates at different times...a lot of folks (algos?) rely on the 10-year treasury rate - often tweaked a bit for opportunity cost and risk - as a popular starting point.

And when you've got a large chunk of stocks in the broader market trading at high valuation multiples...or, say, if a disproportionate % of the S&P 500 is concentrated in a few highly valued growth companies...and interest rates move up unexpectedly, then the broader market and bonds oughta start moving in sync together. Two sides, same coin. Which is what we have seen of late.

Now, at a high level...one of the implicit assumptions of "value investing" like we do here is that money - or 'capital,' to be more precise - is scarce.

And because of that scarcity, that capital should be allocated carefully - among all the possible opportunities available in the market to ya.

For some time now, however, capital has not been scarce. Since the Great Recession, really. And I would argue that since then, good capital allocation has not mattered much to a lot of investors - nor to a large number of management teams.

Not to say they've been wrong in that approach. I mean, yeah, the record will show that "growth" has trounced "value" for some time now. And if you're trading a lot, or have a short-term focus, then the optimal strategy may very well be to chase liquidity and momentum and growth...rather than focus on value.

But in terms of first principles: valuations always matter in the market. At some point.

And an increase in the discount rate - especially an unexpected one - will disproportionately affect growth stocks more than value stocks - because growth stocks typically have more of their cash flows in later years than traditional value stocks.

Which means that an increase in interest rates (that "discount rate") will penalize the present value ("PV") of growth stocks more than value stocks. In theory, and all things being equal.

Now, to be clear...interest rates are still - historically speaking - insanely low. It's more the sudden rise in interest rates lately that has spooked some investors. And it's important to understand - there are sooooo many factors that influence interest rates. In the short run, for instance, the buying and selling of bonds can mechanically push rates lower or higher. And then like last year, early in the pandemic, folks often bought Treasuries as a "flight to safety" - which increases the prices of these bonds and lowers their yields.

The point is that over time, interest rates will settle in at a level that corresponds to expectations of economic growth and inflation. So rising rates also signal the possibility of stronger growth ahead...which is often positive for riskier assets - including growth stocks.

And although spikes in interest rates can be disruptive - especially if they impact the borrowing costs of individuals and corporations...gradually rising rates are usually a positive sign for stocks - once all the dust settles. But, you know, that rise may be decidedly more positive for one particular cohort of stocks than the other, follow me?

Soooooo....no, I am not real concerned about this recent wobble in growth stocks expanding into something that collapses the entire stock market. This spike in rates is just that - a spike, and once things settle in a bit, I think the new consensus that should emerge around a gradual, controlled lift in interest rates over the long-term should start to be seen more clearly for what I believe it to be:

Consistent with the positive economic data over the past several weeks...including an improving job market, recovering industrial production - and the on-going rollout of vaccines.

At the moment, then, I am not real worried about a market correction, an overheating economy and accelerating inflation. (Though those last two things would be good for energy...so root your team on however you may see fit.) Either way - the corona recovery is still in its early stages.

All of which is a long-winded way to say, "Let tech stocks do whatever tech stocks will do" this year. In energy, we are gonna...

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 4, 2021WTI up 1.6% to $62.30, nat gas down 1% to $2.79.

Cale

March 4, 2021WTI up 1.6% to $62.30, nat gas down 1% to $2.79.

Lot of tabs open to the OPEC+ meeting today. Here's the link, FWIW. Will keep you posted on the final formal announcement when I see it. Lotta trial balloons and punditry being floated around in the meantime. The ministers do seem to have been unusually quiet overnight.

Bloomberg reporting Houthis in Yemen have claimed they struck three targets in Saudi. Missile and drone strikes on an oil facility and a military base. Damage unclear - if any. Not particularly critical targets in the global-oil-market sense.

Seems like a continuation of Iran's recent efforts to ratchet up tensions. That's a bad strategy, IMHO, but perhaps it's also a bit more about Iran's coming elections than their foreign policy per se. Inscrutable as ever, but stay tuned.

Thursday assorted links

1. U.S.-Saudi Relations: Same As It Ever Was

Feels like there may soon be more of those 'Substack' newsletters than Taco Bells. But hey, some seem to be quite good - so go nuts, emailers.

2. Exxon scales back shale ambitions to focus on lower costs, dividend preservation

Oil and gas production spending will focus on Guyana, Brazil and U.S. shale oil. The company expects its 400,000 barrels of daily output in west Texas and New Mexico to rise to about 700,000 by 2025, “based on market conditions,” said Senior Vice President Neil Chapman. Two years ago, it forecast 1 million barrels per day in the Permian as early as 2024.

3. Oil And Gas Will Not Be Left Out Of The Energy Transition To Net-Zero, Biden Team Emphasizes

4. WSJ: Cathie Wood’s ARK Investment Faces Reckoning as Tech Trade Stalls

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

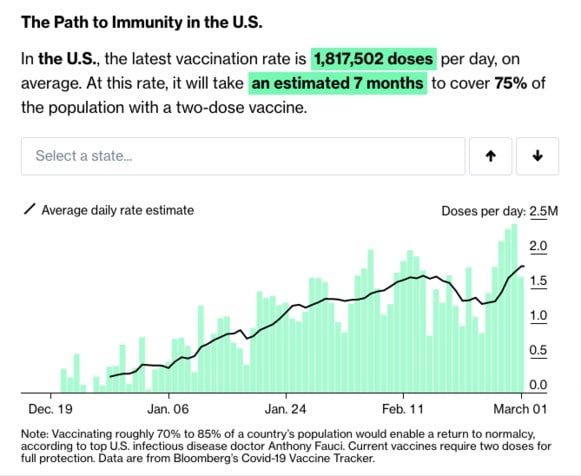

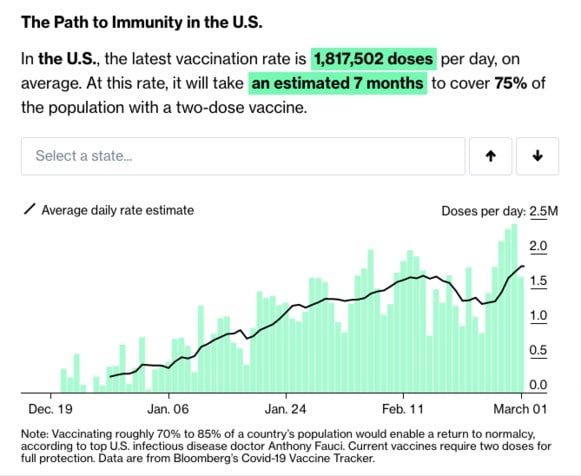

March 3, 2021Futures up on fiscal stimulus deal and vaccines. POTUS vowed there will be enough vaccine for all U.S. adults by the end of May.

Cale

March 3, 2021Futures up on fiscal stimulus deal and vaccines. POTUS vowed there will be enough vaccine for all U.S. adults by the end of May.

WTI up 1.5% to $60.67, also due to OPEC apparently turning cautious about a production increase tomorrow. Nat gas up by about the same amount to $2.88. Weather turning bullish. Plus, you know, the random Brownian motion of nat gas prices.

The OPEC+ JMMC meeting just started a few minutes ago, full ministerial meeting tomorrow.

Late yesterday, consensus appeared to be that OPEC+ will announce a 1 mm to 1.5 mm bopd increase in production tomorrow, for April.

Not enough drama yet, though, so starting to see this sorta thing this morning:

OPEC+ considering oil output roll over for April, sources say

OPEC and other oil producers, a group known as OPEC+, are considering rolling over production cuts into April instead of raising output as oil demand recovery remains fragile due to the coronavirus, three OPEC+ sources told Reuters.

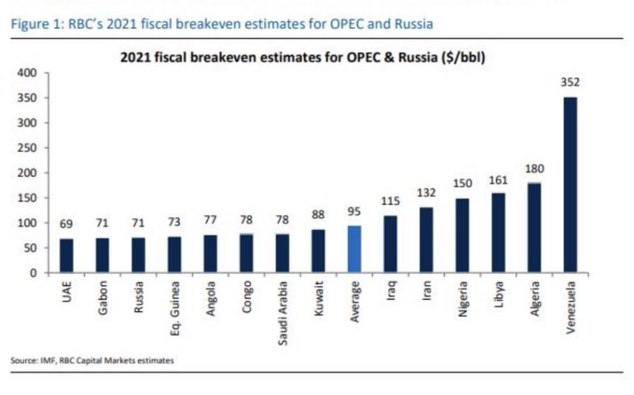

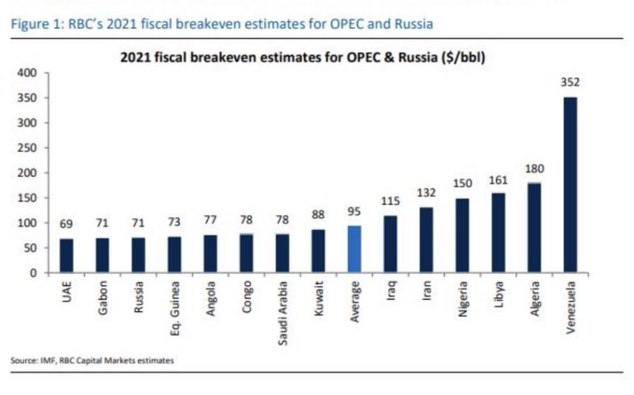

Stay tuned. Not enough time in the day to chronicle every trial balloon/signal/headfake that we will see prior to tomorrow's ultimate decision. So, eyes on...but will try to spare ya the clickbait. And in the meantime, as a reminder from RBC:

As Charlie Munger said:

Show me the incentive and I will show you the outcome.

Quiet from our companies this morning. Have a one-on-one call with one of our CFO's later today, notes to follow on the private boards. Also will post some highlights from Goldman's latest on the "reflation trade" over there.

Wednesday assorted links

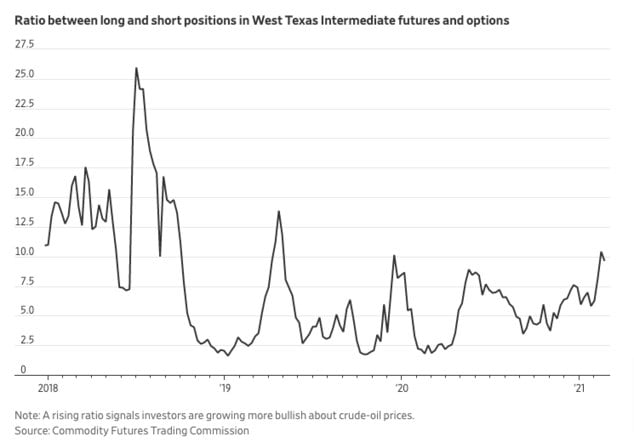

1. WSJ: How the Oil Market Bounced Back From a Year of Crisis

2. Reuters: OPEC oil has advantage over U.S. shale during pandemic recovery

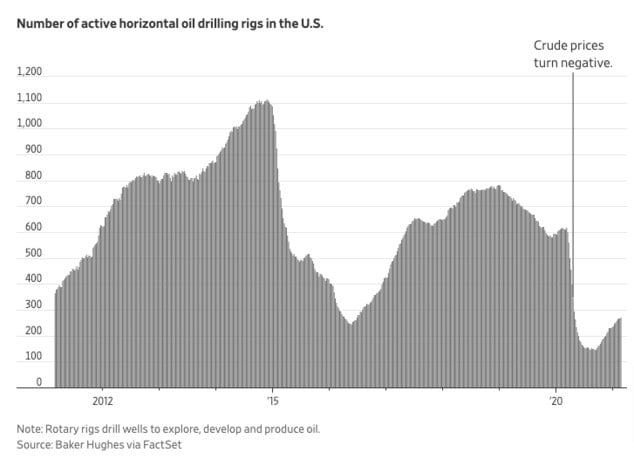

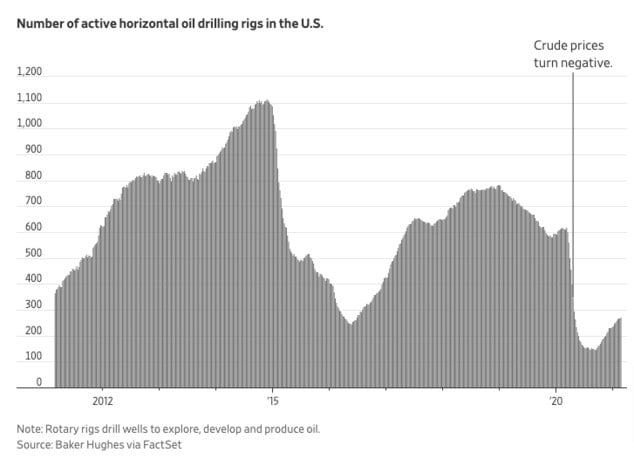

In the past, rising prices have enticed shale companies to ramp up production even after they promised prudence, and $60 oil would have once prompted companies to rush drilling rigs and frack fleets back to work. That is not happening now.

“They are not taking the bait,” LeBlanc said.

Private companies are likely to increase oilfield activity, but not enough to meaningfully boost U.S. output, said LeBlanc, adding that U.S. spending is likely to remain around $60 billion, flat with 2020, as companies prioritize shareholder returns.

“The severe drop in activity in the U.S. along with the high decline rates of shale and the pressure from investment community to maintain discipline instead of growth means in my view that shale will not get back to where it was in the U.S.,” said Occidental Petroleum CEO Vicki Hollub.

3. Reuters: House Democrats seek reform of federal lands drilling program

U.S. Democratic lawmakers in Congress on Tuesday introduced a set of bills to reform federal oil and gas leasing regulations, including by raising royalty rates and toughening cleanup requirements.

The bills would update decades-old laws governing oil and gas drilling to boost the program’s value for taxpayers. While the proposals would not deliver on President Joe Biden’s campaign promise to stop issuing new leases to fight climate change, they could be applied to existing leaseholders if passed into law.

Noting the potential change in royalty rate from 12.5% to 18.75%. An attempt to apply that change to existing leases, though, would almost certainly end up in the Supreme Court. "Government taking" and what-not.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 2, 2021WTI up 0.43% to %60.90, nat gas up about the same to $2.79.

Cale

March 2, 2021WTI up 0.43% to %60.90, nat gas up about the same to $2.79.

Joint Technical Committee of OPEC starts to meet today. May also see some more headlines out of the CERAweek conference. Reuters round-up of day one below.

And Bloomberg noting 76.9M vaccine doses administered in the U.S. so far...and more than 245 million shots given worldwide.

More, please.

Today's Narrative Violation:

WSJ: Oil Trade Group Is Poised to Endorse Carbon Pricing

The oil industry’s top lobbying group is preparing to endorse setting a price on carbon emissions in what would be the strongest signal yet that oil and gas producers are ready to accept government efforts to confront climate change.

The American Petroleum Institute, one of the most powerful trade associations in Washington, is poised to embrace putting a price on carbon emissions as a policy that would “lead to the most economic paths to achieve the ambitions of the Paris Agreement,” according to a draft statement reviewed by The Wall Street Journal.

“API supports economy-wide carbon pricing as the primary government climate policy instrument to reduce CO2 emissions while helping keep energy affordable, instead of mandates or prescriptive regulatory action,” the draft statement says.

API’s executive committee was slated to discuss the proposed statement this week. In a statement to the Journal, API’s senior vice president of communications, Megan Bloomgren, said the group’s efforts “are focused on supporting a new U.S. contribution to the global Paris agreement.”

Tuesday assorted links

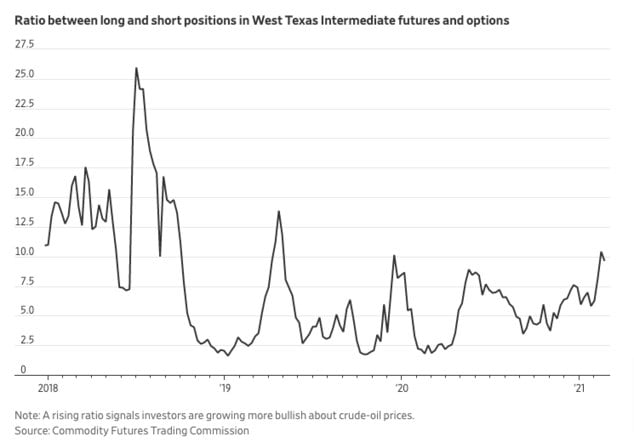

1. Reuters: Oil optimism unwinding market's mad dash for storage

We are now in full backwardation and we are seeing contracts expire without renewals.

2. BBG: Warren Buffett Won’t Take the Reddit Bait

3. WSJ: Charlie Munger Renews Robinhood Criticism, Likens App to Racetrack Betting

I hate this luring of people into engaging in speculative orgies. [Robinhood] may call it investing, but that’s all bullsh!t.

4. Reuters: Energy leaders grapple with climate targets at virtual CERAWeek

“There just isn’t yet enough renewable energy to fuel all of the energy that people need. That’s in developed countries,” said Andy Jassy, head of Amazon Inc’s cloud division who will succeed Jeff Bezos as CEO this summer.

He said the company had announced its goal for net zero emissions at a time when it had not entirely figured out how to get there.

5. BBG: This Week May Turn the Tide on Two Centuries of Emissions

That’s why the climate and energy plans that will be presented in China’s 14th Five Year Plan this week represent the most important policies being made anywhere in determining the fate of the planet.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards