-

Cale

October 1, 2021In case you did not see this last night - an important signal, IMHO:

Cale

October 1, 2021In case you did not see this last night - an important signal, IMHO:

BBG: China Orders Top Energy Firms to Secure Supplies at All Costs

So China's top officials have directed state-owned energy firms to secure energy supplies at all costs. Not tolerating power blackouts - and some concern power issues could ding economic growth. Orders apparently came from Vice Premier Han Zheng, who oversees China’s energy sector and industrial production.

OPEC+ meeting Monday. Expect more trial balloons between now and then. Consensus still is for a 400k de-curtailment. Staying tuned.

Assorted Friday links

1. Platts: Cautious OPEC+ deliberates output levels, as US, China seek more oil on the market

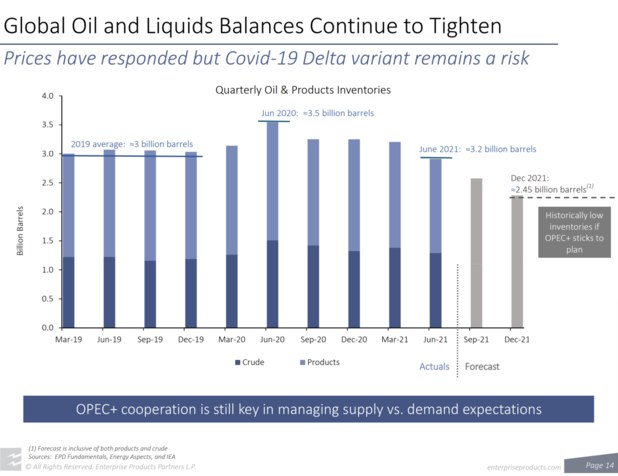

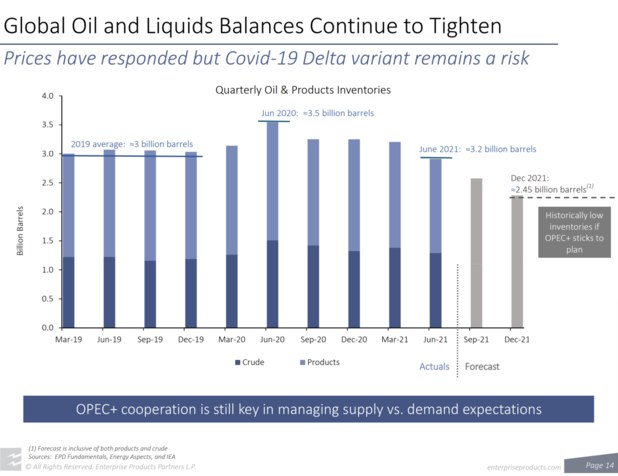

In the month since OPEC and its allies last met, oil prices have hit three-year highs, flirting with $80/b and bringing renewed pressure from the White House to tame the rally.

The OPEC+ alliance is already scheduled to raise output by 400,000 b/d each month, but with China reportedly in search of more supplies and US production still hobbled, ministers may have ample reason to consider pumping beyond those limits, when they convene Oct. 4.

But they may also have plenty of motivation to stick to their plans, given the uncertainty that still surrounds the trajectory of the coronavirus pandemic.

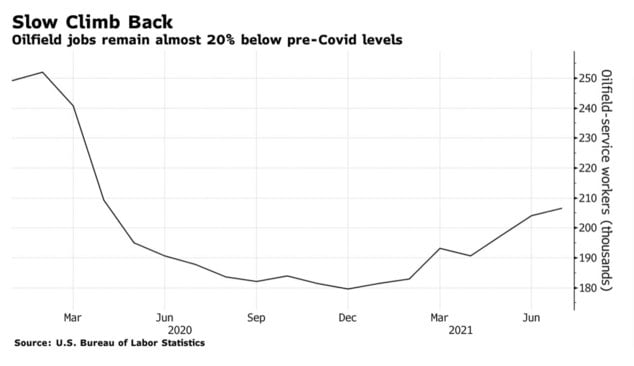

2. BBG: Record Costs Slam U.S. Drillers as Oil Output Growth Slows

3. IEF: 4 Reasons Natural Gas Is A Critical Part Of The Energy Transition

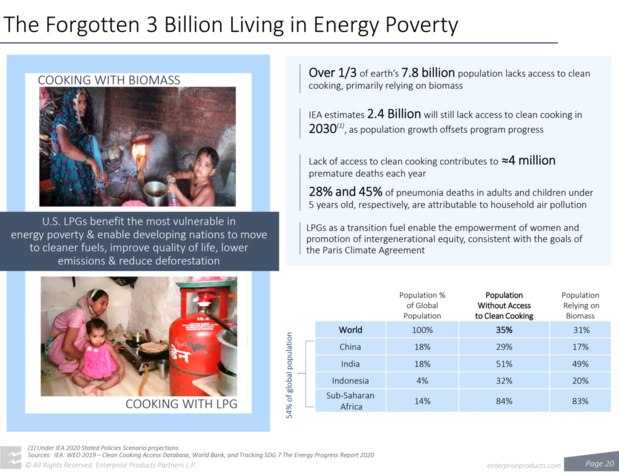

The versatility of natural gas is one key to its expected prominent role in the energy transition, serving as an energy source for all sectors including heating, cooking and industrial applications. When it comes to greenhouse gas emissions, natural gas has a significant advantage over coal, emitting about half the CO2.

This makes it an attractive option for stabilizing the path to renewables while reducing carbon emissions in the short term.

4. CNBC: Five key takeaways from OPEC’s 2045 oil outlook

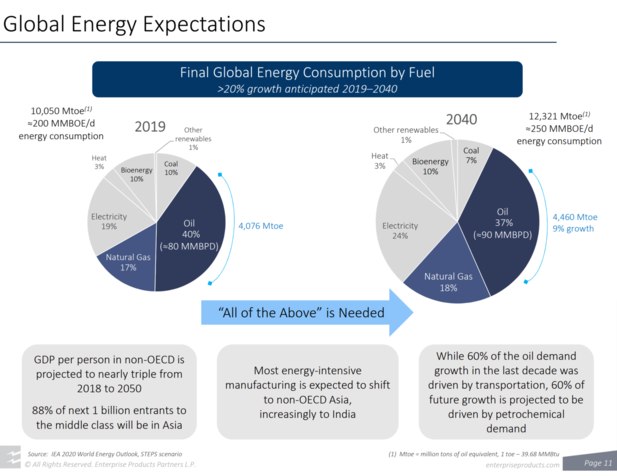

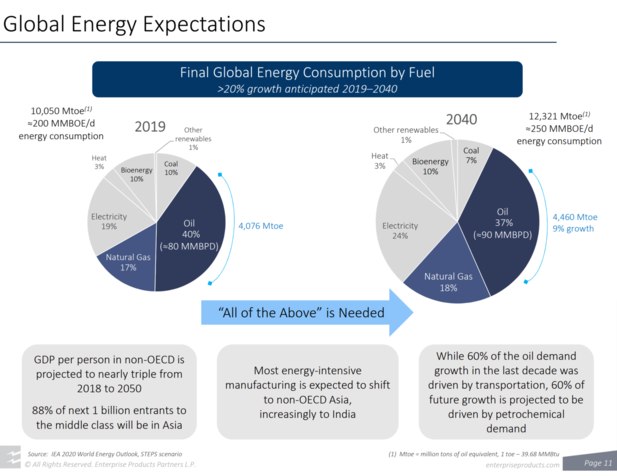

Global primary energy demand is expected to increase by 28% in the period between 2020 and 2045, with all energies required, driven by an expected doubling in size of the global economy and the addition of around 1.7 billion people worldwide by 2045. All energies witness growth, with the exception of coal. Renewables see the largest growth, followed by gas, but oil is still expected to retain its number one position in the energy mix.

And here is the full 2021 World Oil Outlook.

5. Reuters: APPEC-Asian LNG prices set to spike more this winter on low inventories

Arb opportunity between U.S. and global prices the highest it has ever been.

6. BBG: Blinken Says There’s ‘Limited Runway’ For Iran Nuclear Talks

Secretary of State Antony Blinken said Iran is running out of time to get back into the 2015 deal that limited its nuclear program, as officials signal their concerns that a new agreement may be out of reach.

Blinken was careful not to put a time limit on U.S. patience but reiterated that the Biden administration wouldn’t wait forever for Iran to decide to rejoin talks on both sides coming back into compliance with the Joint Comprehensive Plan of Action. Former President Donald Trump quit the deal in 2018.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

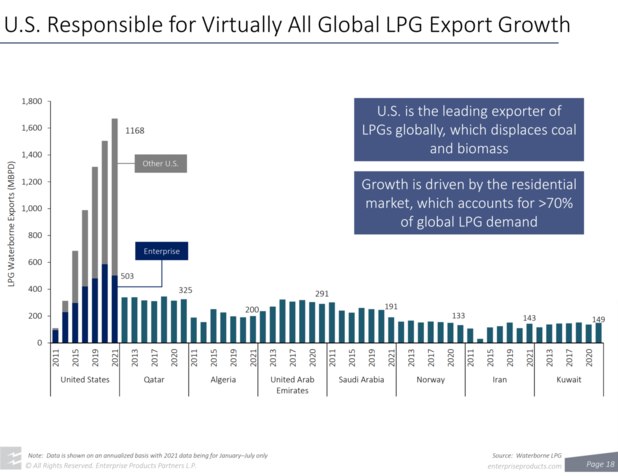

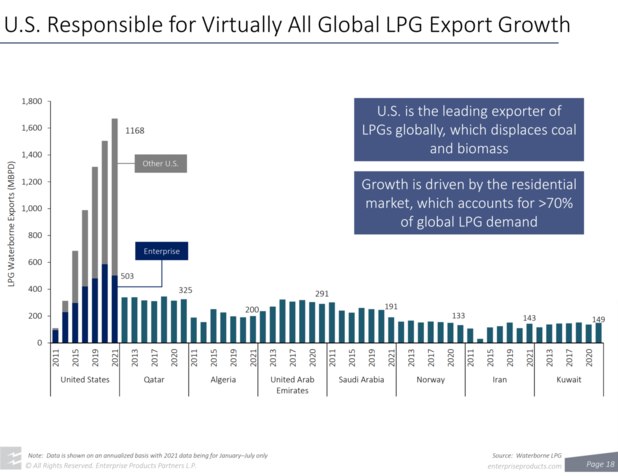

September 1, 2021Lotta eyes on OPEC today, but nat gas - and propane - continue to be worthy of attention here as we head into winter...

Cale

September 1, 2021Lotta eyes on OPEC today, but nat gas - and propane - continue to be worthy of attention here as we head into winter...

1. BBG: Emerging Asia Faces Power Curbs, More Pollution on Gas Rally

Short version: LNG prices in Asia are so high that some countries like Pakistan and Bangladesh have ceased buying spot cargoes...and are now buying and burning oil instead. And, you know, winter is coming.

JKM is now close to being above $11/mmbtu thru 2023. Big Green Light for LNG arb there...quick math, simple numbers, ignoring small terminaling fees...

- sourcing: $4/mmbtu

- transport to facility and liquefaction: $1

- ship transport to destination: $1.3

- total cost delivered: $6.3

So $11 minus $6 = moar molecules of freedom. And if ya consider that JKM breaks higher than $12 for several months in there....let's round up and call the current arb at the low a nice 100% return per cargo.

Good for U.S. LNG exporters - and likely for nat gas producers in the Haynesville, too. Eyes out for consolidation there soon, IMO.

2. G&R: North American Gas Markets Now in Deficit

The main challenge faced by US natural gas has been the unrelenting growth of the Marcellus and Permian. If we are correct and both plays are entering the early stages of exhaustion, then a new gas bull market has likely started.

3. On the carbon front...

WSJ: Energy Traders See Big Money in Carbon-Emissions Markets

The value of the carbon market could exceed the oil market’s value by 2030, possibly even by 2025 if swift action is taken and regulations are implemented.

4. This Week's Sign That Predicting The Future Is Hard:

BBG: Wall Street During the Pandemic: The Impossible Is Now Commonplace

If someone would have told me in March of last year, when Covid was first rearing its ugly head, that 18 months later we would have case counts that are as high - if not higher - than they were on that day, but that the market would have doubled over that 18-month period, I would have laughed at them.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

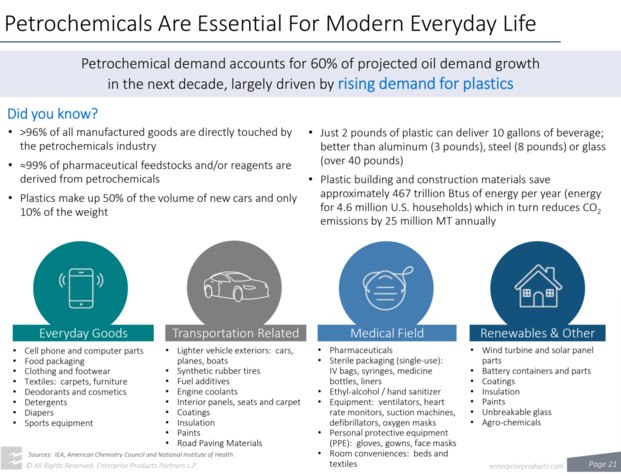

August 30, 2021Handful of recent slides from unowned companies of note to me this earnings season...

Cale

August 30, 2021Handful of recent slides from unowned companies of note to me this earnings season...

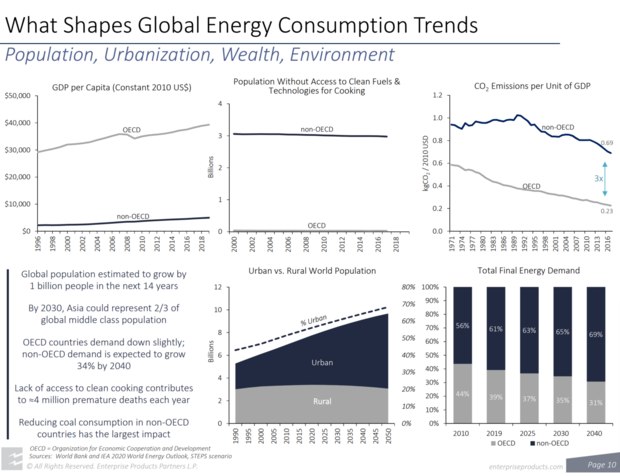

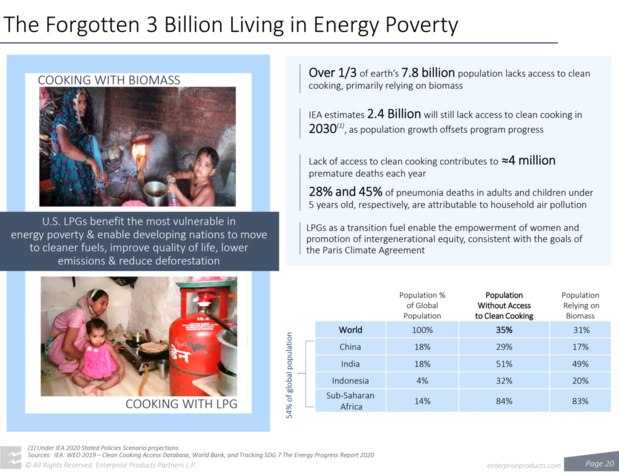

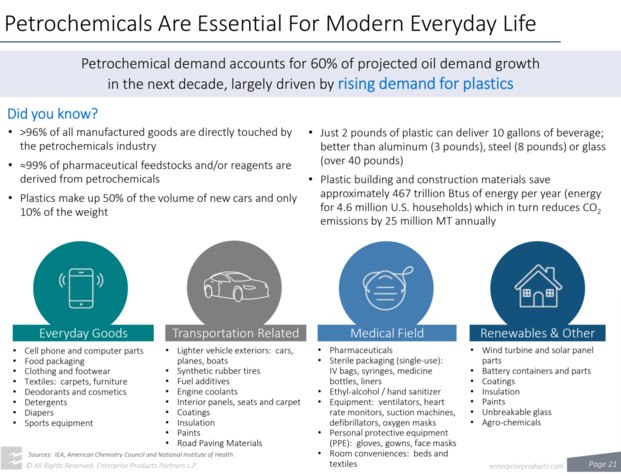

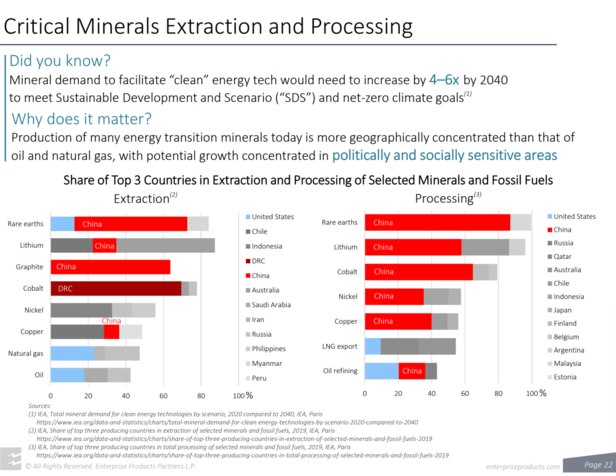

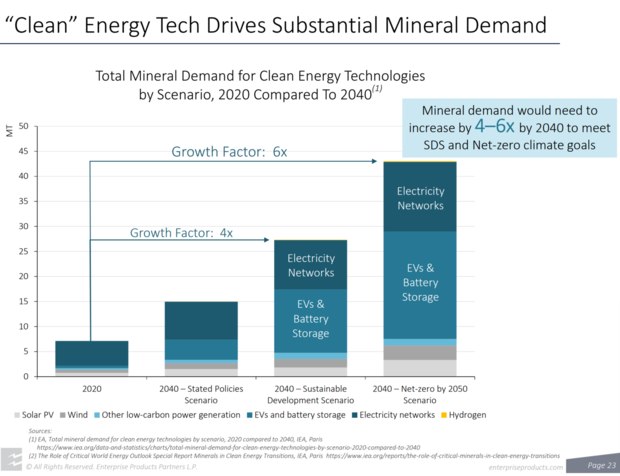

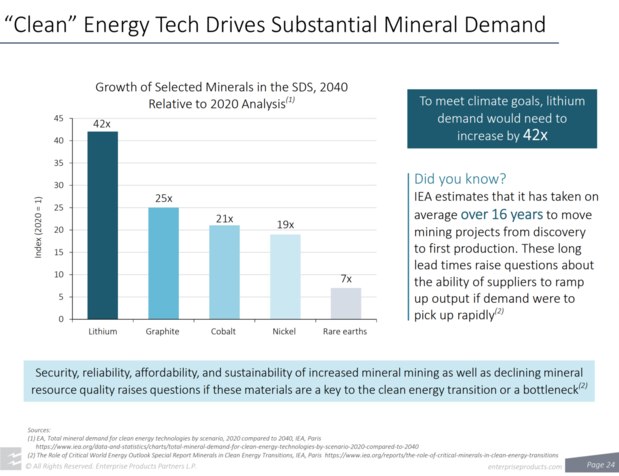

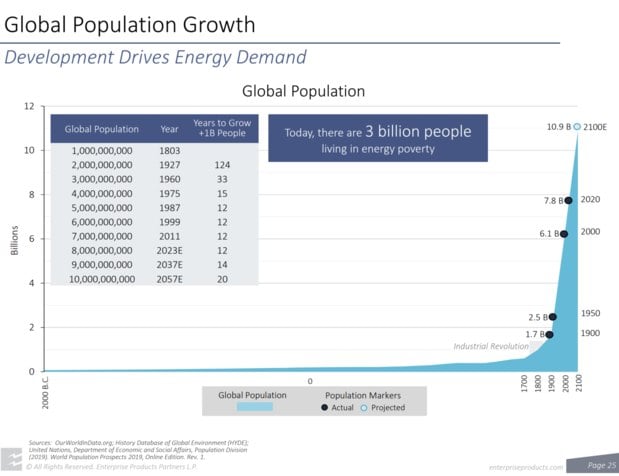

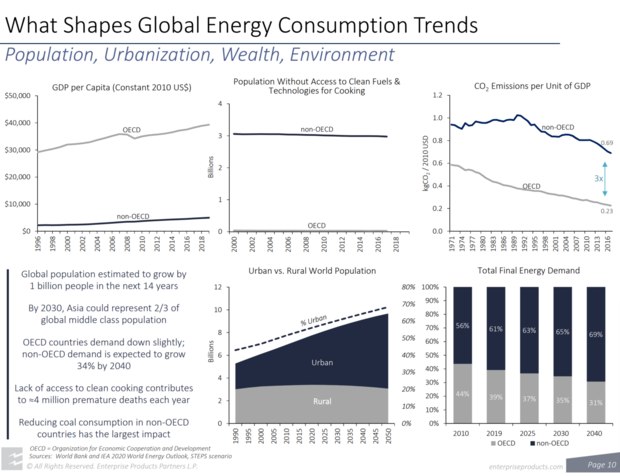

From $EPD here:

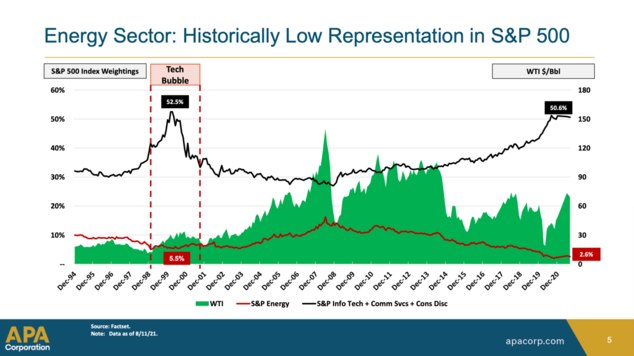

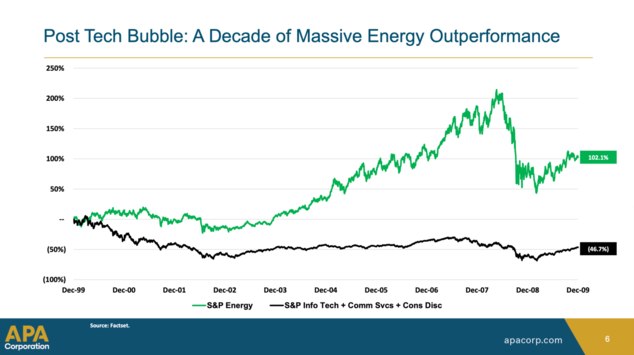

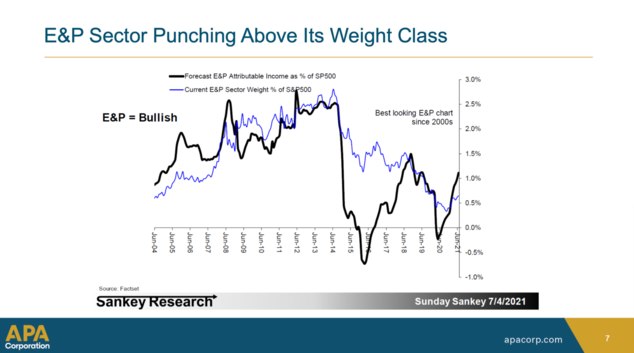

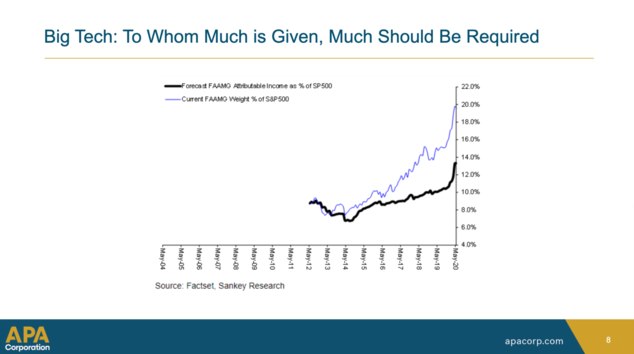

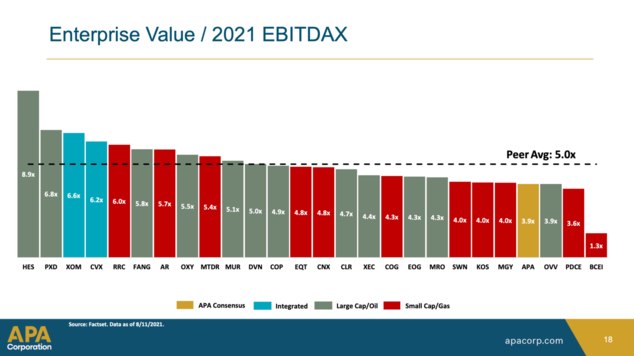

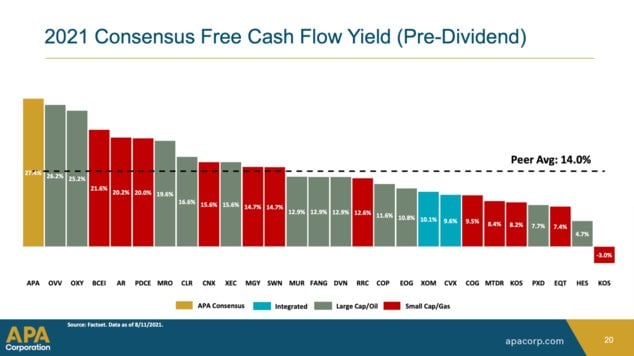

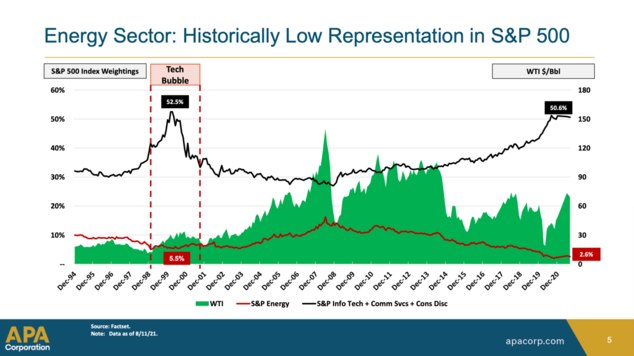

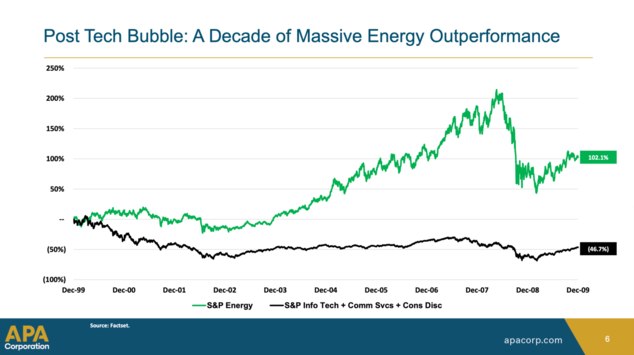

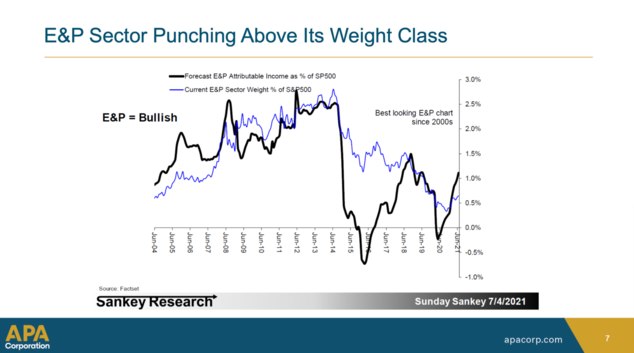

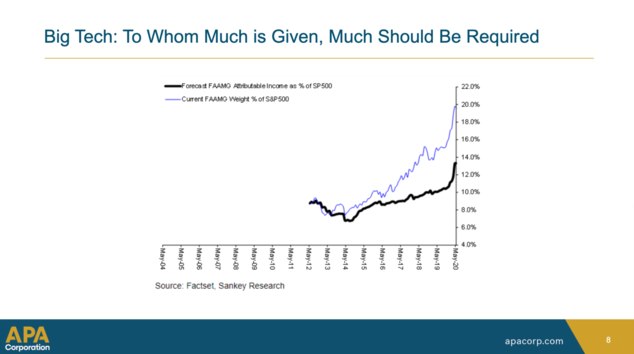

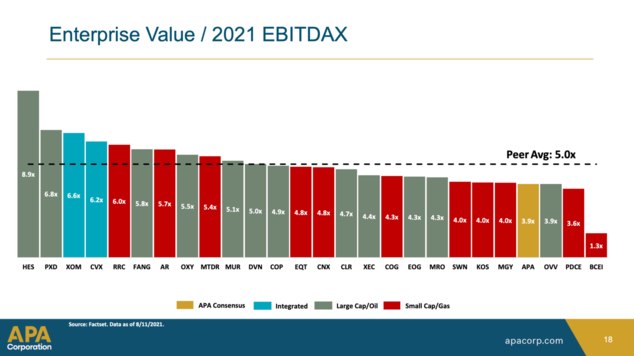

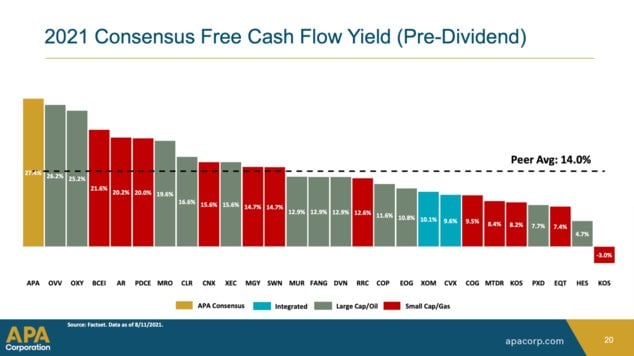

From $APA here:

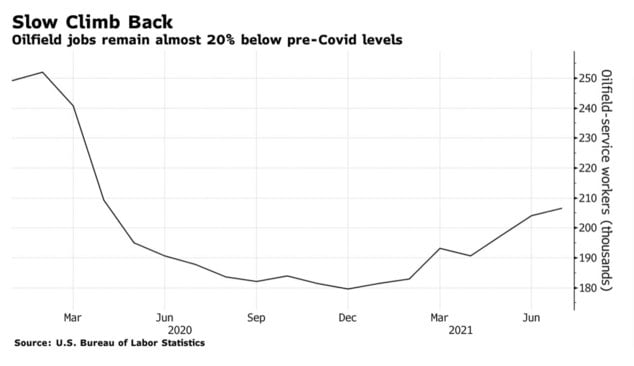

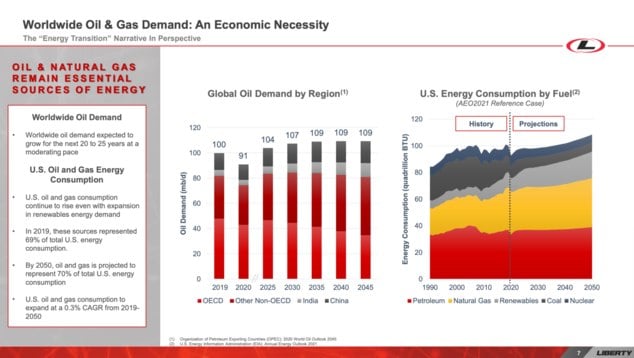

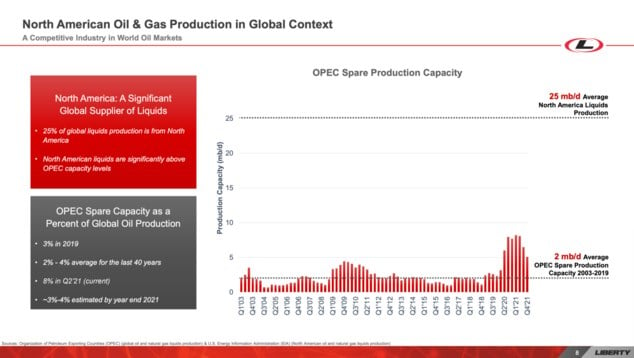

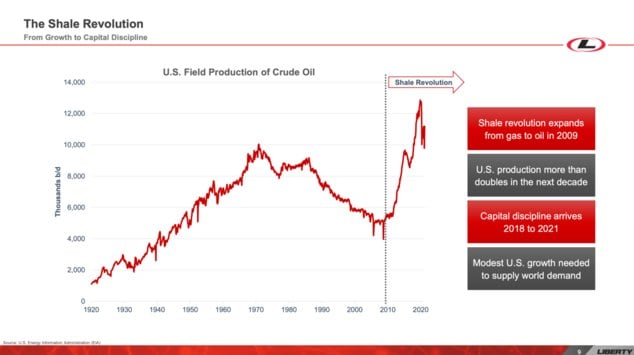

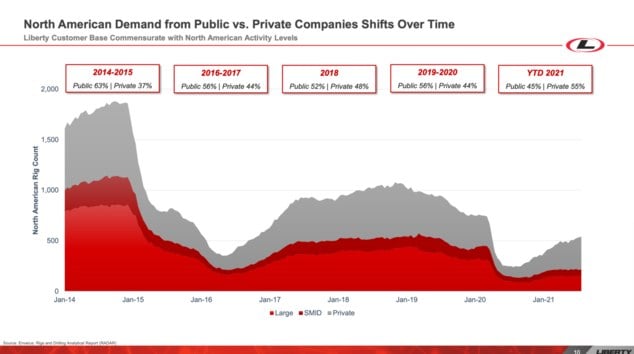

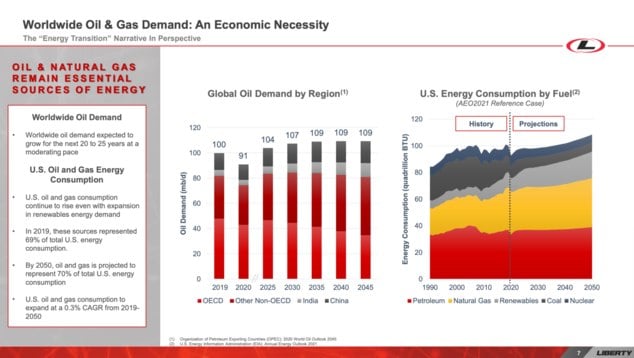

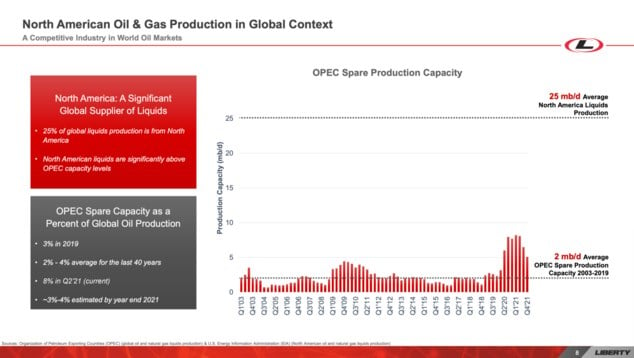

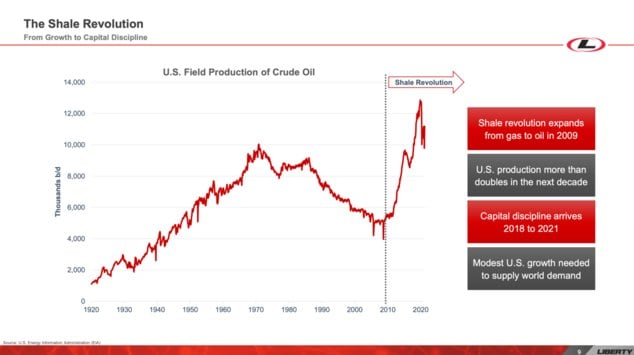

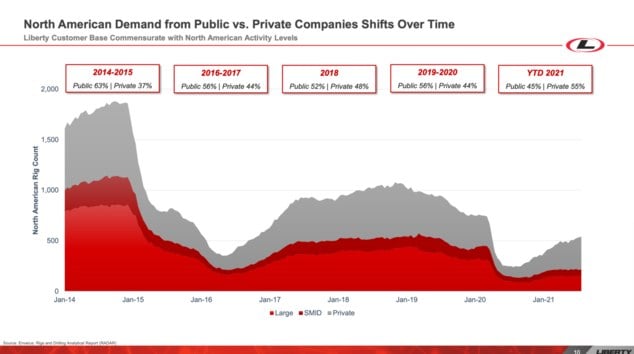

From $LBRT here:

Narrative violations starting to pop up more and more...

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

August 2, 2021New month, new open thread for public posts.

Cale

August 2, 2021New month, new open thread for public posts.

Back late last night, meeting this morning, then leaving for a week-long conference up the road again.

Will be back on here a bit more regularly starting next week.

Thank you and more then.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

June 28, 2021For the next month or so, my posts on the public boards will be light.

Cale

June 28, 2021For the next month or so, my posts on the public boards will be light.

That'll start today and will last through the end of July.

Need to re-prioritize some things during a month with zero slack on the calendar. Lotta things happening here in and out of the office.

Will continue to have eyes on everything - and will continue company-specific posts on the private boards.

Also will publish a Q2 letter within the next few weeks, and will post a publc link to that here as well.

So, I don't anticipate many public posts from yours truly this coming month. Post however you'd like, though, of course, on this thread or elsewhere.

On the private boards, I will start a single thread for the month of July soon. Going to attempt to limit my own posts there to company-specific news and filings...a delayed summary at the end of each day, rather than pre-market, as usual...and then to answer any questions that pop up, too.

Fire away with any questions and comments for me whenever. Just may take me a bit longer to respond here on the boards than usual as I juggle a couple of other things this month.

Thank you for the patience. Really enjoy these boards, and hope you all do, too. Also hope to finally start knocking out some things in July that I think will make them even better...

- Cale

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards